DHL Express customs clearance options for private individuals

Shipments of any value sent from outside the European Union are subject to customs clearance. VAT is charged on shipments of any value. Shipments up to 150 EUR may be exempt from customs duties. If the value of the consignment is over 150 EUR, the consignment is subject to VAT and duty.

DHL Express customs options for private individuals

1. Clearance through DHL Express

The first option available to private individuals is to clear the shipment via DHL Express.

In this case, the client fills out our online customs form and we clear the shipment at the customs office. The client will then pay us the fees assessed by the customs office (VAT, customs duty, ...) according to the value of the shipment. Furthermore, the client may be charged fees according to our valid price list.

If we pay the fees assessed by the customs office on behalf of the client (VAT, customs duty, ...), then the client pays a fee of 400 CZK excluding VAT (484 CZK including VAT) for the payment to the customs office. If the value of the customs debt exceeds 20,000 CZK, then the client pays a fee of 2% of the total amount of duties and taxes.

Other charges that may be incurred on a shipment include storage in a bonded warehouse and multi-item SAD.

The customs warehousing fee is charged from the 3rd day that the shipment is in the Czech Republic and has not been through customs. The amount of the fee is 314.60 CZK incl. VAT plus a coefficient of 6.05 CZK incl. VAT per kilogram of the consignment and is charged for each additional day. The charge for this fee ends when the shipment is released by the customs office.

The multi-item SAD fee is charged in cases where the customs declaration contains 6 or more items. The amount of the fee is 130 CZK for each additional item (i.e. sixth item of a different type and others).

2. The client sets himself at the customs office (handover protocol)

The second option is that the client clears the shipment himself. The client pays the fees charged by the customs office (VAT or customs duty) based on the value of the shipment. In this case, a storage fee may also be incurred in our customs warehouse (if the shipment is stored in the Czech Republic for more than 3 days and has not been cleared).

If the client wants to clear the shipment themselves, they need to specify on our customs form that they do not agree to our terms. Once the shipment arrives in the Czech Republic, the client will be sent a handover report and the shipment documents to their email address.

If the value of the shipment is up to 150 EUR, then non-VAT payers have the option to clear the shipment themselves via the Customs website Celnička (https://celnicka.cz/cs). The consignee enters the information about the consignment from the handover report into the customs portal, clears it in this way and then pays the customs fees. Once the customs office informs us that the shipment has been cleared (usually the customs office informs us within 2-3 days of the clearance and payment of customs fees), we can forward the shipment for delivery or personal collection if the recipient wishes.

For consignments over 150 EUR, clearance takes place in person at the predetermined customs offices where the consignment falls (Prague Zdiby - Pražská 180, 250 66 Zdiby; Brno - Řípská 9, 672 06 Brno, Brno; Ostrava Mošnov- Gen. Fajtla 372,742 31 Mošnov) and collect the shipment personally.

After the completion of the customs procedure at the customs office, it is necessary to send a customs clearance document (CSD) to the email address specified in the handover protocol, specifying whether the client wishes to collect it personally at our branch (Ostrava Mošnov - Areál leteckého Cargo, module 8; Brno - Brno-Tuřany Airport, 627 00 Brno; Prague Zdiby - Parkerova 626, Klecany) on the same day, or to deliver the shipment to the address on the next working day.

3. Rejection of an unpaid consignment

The last option is to reject the shipment. In this case, DHL Express will contact the shipper/payer on how to proceed with the shipment. If the shipment has not yet been cleared, the consignee in the Czech Republic will not be charged for the rejection.

Customs form

To clear the shipment, it is necessary to fill out our DHL4U customs form, which is automatically sent to the e-mail or telephone number entered by the sender on the invoice and consignment note. After opening this form, the client proceeds as follows:

- Specifies whether the shipment is for a private person or a company.

- Generates an EORI number.

- Specifies the customs clearance method.

- Checks the documents from the sender.

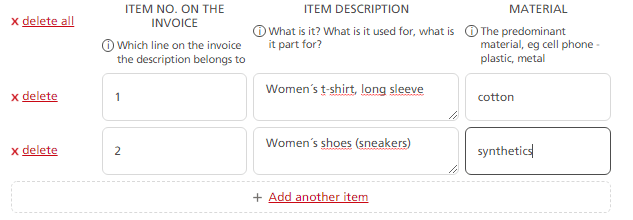

- Give the exact description of the goods, the predominant material from which the goods are made and the item number on the invoice (always indicates the given line).

As an example, we will describe an invoice with two lines (items), where the first item is a T-shirt and the second item is shoes:

The most common ways of exemption from customs duties for private individuals

Moving

(Art. 3 NR 1186/2009; more information can be found on the website of the customs administration: https://www.celnisprava.cz/cz/clo/informace-pro-fyzicke-osoby/...)

The first situation in which a shipment can be exempted from customs duties (but not from DHL fees) is moving. The removal article can be accepted if the person has been abroad for more than 12 months and if the necessary documents are provided. The recipient needs to provide a power of attorney, proof of stay abroad for more than 12 months (housing contract, study contract, employment contract, etc.), airline tickets, passport and an accurate list of items with their intrinsic value (the goods in the shipment must be used). The assessment of this article depends on the customs office.

Goods between two private individuals up to 45 EUR

(Art. 25 NR 1186/2009; more information can be found on the website of the customs administration: https://www.celnisprava.cz/cz/clo/informace-pro-fyzicke-osoby/...)

If a private person sends a consignment up to 45 EUR to another private person, then this consignment may be exempt from customs duties (but not from DHL fees). Exemption is decided by the customs office, which may request the value of individual items to prove it. The client can prove the value, for example, by ordering the item, payment, or another way of proving the market value according to reality (for example, an Internet link to similar or identical goods, etc.).

Non-commercial goods in each consignment are exempt from import duties only up to a value of 45 EUR, including the value of the goods listed below, without the consignee paying anything to the consignor.

a) tobacco products:

– 50 cigarettes, or

– 25 cigarillos (cigars weighing not more than 3 grams each), or

– 10 cigars, or

– 50 grams of smoking tobacco, or

– proportional set of these products

b) alcoholic beverages:

– distillates and spirits with an actual alcoholic strength of more than 22% vol .; undenatured ethyl alcohol of an alcoholic strength by volume of 80% vol or higher: 1 liter; or

– spirits and spirituous beverages, aperitifs with a wine or alcohol base, tafia, sake or similar beverages of an alcoholic strength not exceeding 22% vol .; sparkling wines, liqueur wines: 1 liter or a proportionate set of these products, and

– still wines: 2 liters

c) perfumes:

– 50 grams, or eau de toilette: 0.25 liters.

Commodities with special requirements and increased customs control

- Food

If there is food in the consignment, Customs needs to document the exact composition of the item. In addition, a power of attorney from the consignee is needed for customs representation, order and payment. If the consignee does not have payment and/or an order, then an affidavit must be submitted to Customs stating the reason why the documents cannot be provided and supplemented with references to the same or similar goods on the internet. This commodity is under increased customs control, so you must allow for any delays in the customs procedure.

- Alcohol / tobacco / cigarettes

A private individual may import up to a maximum of 10 litres of hard liquor. A power of attorney, purchase order and payment is required from the recipient to clear the shipment. This commodity is under increased customs control, so expect possible delays in customs procedures here as well. Excise tax is assessed by customs at import. If the import limit is exceeded, the shipment cannot be split or a portion removed and cleared. In this case, the instructions of the freight forwarder are followed.

The import of alcohol for personal consumption is regulated by the Act on Excise Duties, § 4, paragraph 5, of the Act on SPD 353/2003 Coll.

(5) For the purposes of paragraph 1 letter (f) quantities of products selected for personal consumption shall be considered to be quantities not exceeding

a) mineral oils, with the exception of liquefied petroleum gases transported in pressure vessels with a charge weight of up to and including 40 kg, the quantity transported in ordinary tanks (§ 63 para. 2) increased by 20 l,

b) liquefied petroleum gases in pressure vessels with a charge weight of up to 40 kg, including 5 pressure vessels,

c) spirits according to the directly applicable regulation of the European Union regulating the definition and description of spirits 10 l of final products,

d) beer 110 l,

e) intermediates 20 l,

f) wines 90 l, of which for sparkling wines 60 l,

g) 800 cigarettes,

h) cigarillos or cigars weighing not more than 3 g / piece 400 pieces,

i) 200 other cigars,

j) smoking tobacco 1 kg.

- Paintings, works of art, collectibles

These items can only be cleared after the recipient's power of attorney, order and payment have been received. No power of attorney or order and payment is required for printed paintings - the item is classified as a printed product.

This commodity is under heightened customs scrutiny, so expect potential delays in customs clearance.

- Antiquities

To clear this type of commodity, you must provide a power of attorney, a certificate from the auction house, or other proof of authenticity (for example, an affidavit with a link to a website listing the year of birth and death of the artist). Proof of age of 100 years or more must be provided for inclusion as an antique. The reduced rate of VAT can be applied once the conditions in Annex 4 of the VAT Act have been met. This commodity is under increased customs control, so please allow for any delays in the customs procedure.

- Plants

Imports of plants are subject to phytosanitary inspection by the Central Institute for Agricultural Inspection and Testing (CIAAT) and the original copy of the phytosanitary certificate must accompany the consignment. Shipments of this commodity are subject to increased surveillance by the state authorities. Submission of the goods for inspection is subject to a fee according to our price list. This commodity is under increased customs control, so please allow for possible delays in customs procedures.

Prohibited commodities:

- Medicines, food supplements

The import of drugs for a private person is prohibited. The customs office assesses whether it is a medicinal product on the basis of Annex No. 2 to Act No. 48/1997 Coll. as amended. If the customs office is not sure, the case will be referred by SUKL (State Institute for Drug Control), which will only issue an opinion as to whether it is a medicinal product or not. All other decisions are within the competence of the customs office. According to SUKL's recommendations, the recipient should contact specialized companies with a license to import medicinal products or seek medical care in the Czech Republic, where he will be prescribed a product with the same or similar composition available in the Czech Republic.

As far as food supplements are concerned, the prohibited commodities mainly concern:

– vitamin D3 (over 1,000 IU)

– melatonin

– collagen of animal origin (fish - Marine is allowed)

– Yohimbine

– Glutathione (GSH)

– collagen and gelatin are allowed to be imported in quantities of up to 2 Kg.

- Animal products (milk, meat and meat products, fish, seafood, etc.)

Private individuals are not allowed to import this commodity. These are mainly meat products, GHEE (renneted butter), etc.

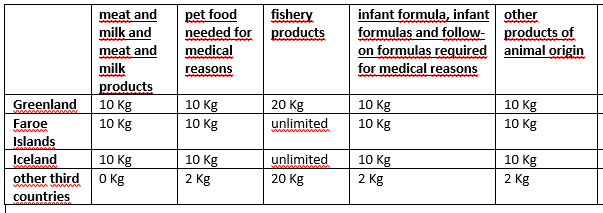

Exception in imports of animal products from countries according to NK (EC) No. 2122/2019

- Live animals, including mammals, reptiles, fish, invertebrates, amphibians, birds, insects, larvae and pupae.

- Hunting (animal) trophies, animal parts such as ivory, shark fins, animal or ash scraps and animal by-products under CITES.

- Human remains or ashes.

- Unstamped precious metals (any precious metal, usually in the form of bricks or ingots).

- Cash (legal tender - banknotes, coins).

- Bulk gems and semi-precious stones (cut or uncut, polished or unpolished).

- Whole firearms, ammunition, explosives, compressed, air-powered, imitation and replica firearms.

- Illegal goods such as counterfeit goods, narcotics.

- In addition, property the transportation of which is prohibited by any law or regulation of any federal, state, or local government in any country to or through which the shipment is transported.

- Radioactive substances.

- Toxic gases.

- Infectious substances classified in category A.

- Other dangerous goods that exceed the limits of the limited amount of ADR.

More information can be found at: https://www.dhlproeshopy.cz/blog/clanek/zakazane-zbozi-v-siti-....

Payment of customs duties

The value of fees is up to 130 CZK

If the customs fees are up to CZK 130, then the client must pay them online or by bank transfer.

The value of fees is 130 CZK - 30,000 CZK

If the fees are from 130 CZK to 30,000 CZK, then the client can pay them online by payment, transfer to the account, or upon receiving the shipment by the courier, in cash or by card via the terminal.

Value of fees over 30,000 CZK

If the customs debt is over CZK 30,000, the client can pay it online by payment, transfer to an account, or card by courier. In this case, payment in cash is not possible.

EORI number

The EORI number is an identification number that everyone who wants to import or export goods must have. Private individuals generate it for each shipment separately on the website of the customs administration: https://www.celnisprava.cz/cz/aplikace/Stranky/eoriadhoc.aspx.

After entering personal data, the EORI number will be displayed in a green box in the format CZ and numbers.

More information can be found on the website of the customs administration https://www.celnisprava.cz/cz/clo/e-customs/eori/Stranky/defau....

Service indicating payment of customs duties

DTP (Duties and Taxes Paid)

DTP is a service whereby the shipper (or third party) agrees to pay any customs fees incurred in clearing the shipment when the shipment is sent via DHL Express. Even if the shipment is sent with a DTP service and the consignee does not pay the customs fees, the shipment must be cleared and we need the consignee's cooperation to clear it.

DTU (Duties and Taxes Unpaid)

DTU is the most commonly used service. It can also be found on the bill of lading and in this case the consignee pays the customs fees.

IOSS

IOSS is a service where a foreign e-shop is registered for VAT payment in the European Union and sells its goods with VAT. In order for the service to be recognised by customs, IOSS must be entered into the system by the sender when ordering the shipment. It is only valid for shipments to non-VAT payers up to 150 EUR. IOSS, in other words, means that when the shipment is cleared in the Czech Republic, the recipient no longer pays the VAT, as it was paid when the goods were purchased.

Freight

Freight is a necessary item for the calculation of customs duty and VAT regardless of who pays it, even if the client is not charged. The customs office in the Czech Republic does not accept free, zero or included freight. It is necessary to know it in order to calculate customs charges. If it is not stated on the invoice, or the valid delivery condition is not stated and the client does not provide us with an order with payment where the freight charge is stated, we have to calculate the freight charge according to DHL tables (its amount is determined by the country of shipment, weight of the shipment and fuel surcharge). The freight charge is not reimbursed by the recipient or the sender, it is only used to calculate the customs charges (VAT and customs duty).

Invoice

An invoice is required for both customs clearance and shipment. The invoice must state the seller/sender, the consignee/buyer, the exact description of the goods contained in the shipment. Each type of goods must be listed separately on the invoice - on a separate line, each goods must have its unit value, final price and the number of pieces and currency must be indicated.